The Delisting Dilemma: Two options

Listing on the NZX is one of the most momentous points in a company’s corporate life. As with all good things, however, the listing can come to an end. There are a number of reasons for a delisting. Most often, the company is subject to a takeover, or the delisting is in part to consolidate the listing in a larger foreign stock exchange (in ASX or in the US).

In slightly less ideal circumstances, delistings are considered to meet the challenges of high and ongoing compliance costs in a low liquidity environment for small-cap issuers. That is, the benefits of listing on NZX no longer outweigh the costs of maintaining it. Companies choosing to delist in these circumstances have generally transitioned to the Unlisted Securities Exchange (USX). More recently, another licensed market to cater to delisting NZX companies has emerged: Catalist Public Market (Catalist).

In this article, we compare USX and Catalist as two viable delisting options, for consideration by company directors and shareholders. Here is a high-level snapshot of the key differences between the three stock exchanges.

While Catalist and USX share some similarities – being light on governance reporting and initial listing requirements – some of their key differences are explained further below.

1. Investor access and fees to trade

One of the key concerns when delisting from NZX is ensuring that shareholders can still trade their shares in a cost effective manner. Liquidity issues and accessibility barriers can discourage investors, reducing confidence in the company’s stock.

USX operates on a broker-only model. Brokerage accounts may not be available to retail investors and if available, investors can face higher than NZX trading fees (typically, 1.5% or $75-$85 per trade). This creates a potential deterrent for shareholders who wish to trade in smaller volumes, so USX is generally more accessible to wholesale, rather than retail investors.

Catalist allows investors to trade directly on its platform via an auction-based system. The auction system, in theory, should help create better price discovery by aggregating the supply and demand to the periodic auction times. Catalist charges fees directly to investors (0.25% or a $30 minimum and $150 maximum per trade). In cases where an issuer is undertaking a capital raise, the investor does not pay any trading fee.

2. Ongoing listing fees

Catalist’s fee structure is based on the number of trading events a company holds each year. The total listing cost is between $5,000 and $16,500, depending on the total number of trading events. There is an initial listing fee of $5,000. USX charges issuers based on their market capitalisations, regardless of trading activity. The annual fee starts at $4,740 for issuers under $2 million market capitalisation and up to $50,000 for larger issuers.

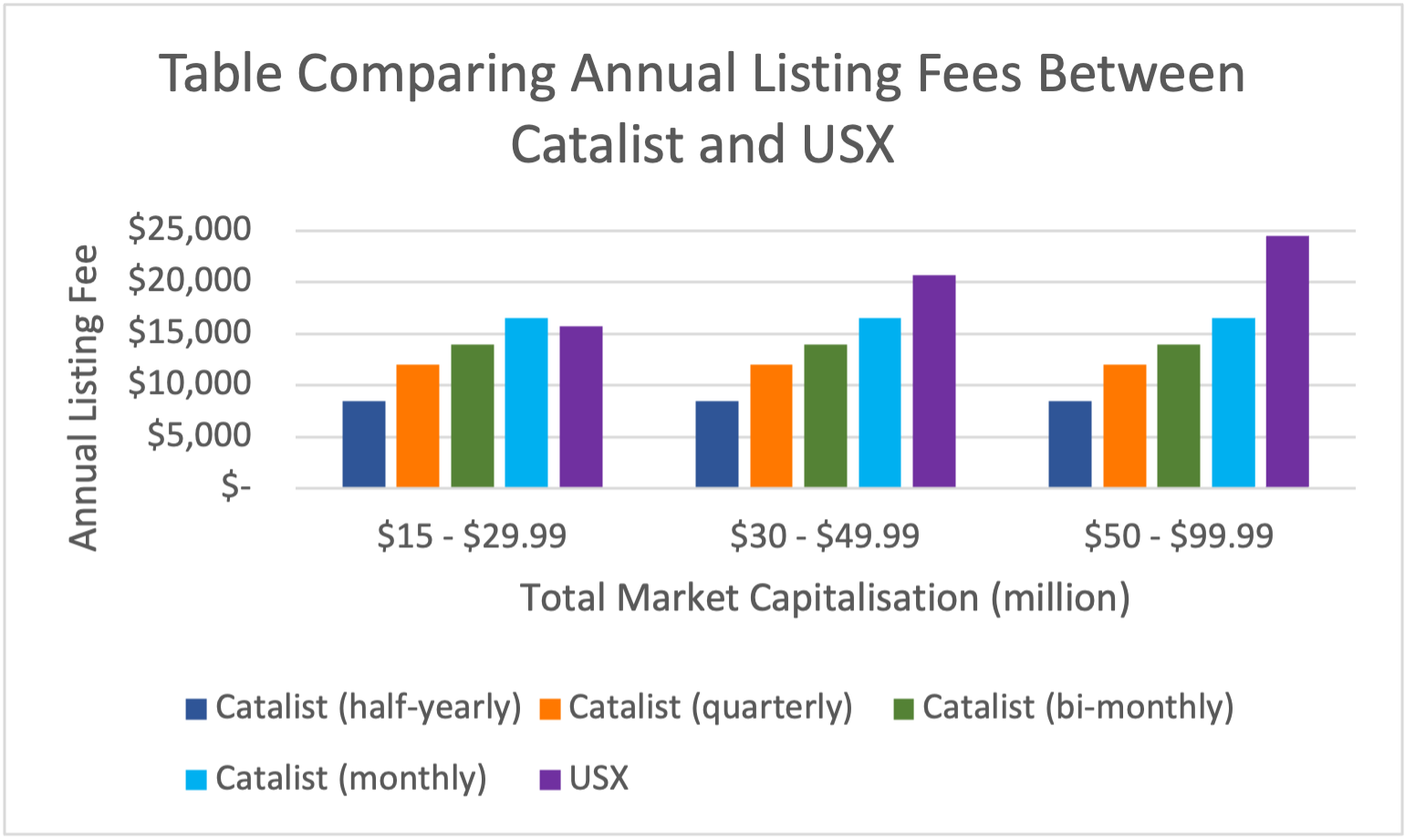

The table below compares the annual listing fees on Catalist and USX for companies valued between $15 million and $100 million. It shows that lower market cap companies incur similar to lower annual fees (depending on the number of auctions) on Catalist compared to USX, but with higher market cap companies Catalist offers substantially lower listing fees.

3. Market licensing and investor protections

Catalist is a licensed exchange regulated by the Financial Markets Authority. It is the only other licensed market after NZX. Investors can take some comfort in and benefit from the legal protections in the FMCA such as protections against insider trading and market manipulation. Substantial shareholders, directors and senior managers must also disclose their share dealings intended to facilitate an open and transparent market. Catalist issuers must also have at least one independent director on their board.

USX operates under an exemption rather than being a licensed financial product market. This means there are no formal investor protections other than those that apply to wholesale markets (e.g. companies can’t lie) and less regulatory oversight. There is also no requirement for any independent directors. The upside to the lite-regulation approach is that it reduces the compliance burden for USX, which allows it to offer a low-cost service, but it means investors have fewer safeguards.

4. Raising new capital

Last but not least, when choosing a listing venue issuers should consider the ability to raise new capital efficiently. While delisting from NZX may reduce compliance burdens, companies may still need access to funding for growth and expansion. Future growth, in turn, entails the possibility of relisting on the NZX and other positive liquidity events for the shareholders.

Catalist offers significant regulatory relief to issuers when it comes to capital raising. Under an FMCA exemption available to issuers on its market, companies can raise up to $2 million similar to a crowdfunding offer and up to $20 million per year from retail investors in a manner similar to the “same class of quoted securities” exemption, in each case without needing to prepare a full Product Disclosure Statement (PDS). This regulatory relief makes Catalist an attractive venue for growth-stage companies.

USX-listed companies do not enjoy similar regulatory reliefs for capital raising from retail investors. If a company wants to raise public funds, it must prepare a PDS or rely on one of the other exemptions available under the FMCA.

Final Takeaway

Catalist and USX both offer alternative listing venues for companies delisting from the NZX, but their suitability depends on a company’s priorities, including potentially relisting on the NZX. USX provides a broker-based trading platform with minimal governance requirements, making it a familiar option for companies focused on maintaining a listing with low regulatory overhead. Catalist, on the other hand, facilitates direct investor access and streamlined capital raising under regulatory exemptions, with theoretically improved liquidity, making it more attractive for companies potentially seeking future retail investor participation. Both exchanges offer minimal governance requirements, and there are some listing cost differences but they do not appear major. Directors should weigh factors like liquidity, compliance costs, capital-raising needs, and potential for a relisting on the NZX and/or other positive liquidity events when choosing the best market for their company’s future.

What next

If you have any questions regarding this article, get in touch with Joshua Woo.

If you liked reading this content and want more, please subscribe here.

Disclaimer

Disclaimer: The author is an associate lawyer at JW Legal. JW Legal performs independent regulation functions at Catalist Public Market. All opinions expressed within this article are solely the author’s and do not reflect the opinions, beliefs or positions of Catalist, JW Legal or other organisations.

This publication should not be construed as legal advice. It is necessarily brief and general in nature. Please seek professional advice before taking any action in relation to the matters discussed in this publication.