AML/CFT requirements

Summary

In some instances, we must complete customer due diligence before we can commence acting on your behalf.

To do so, please complete this form - we may have follow up questions.

Under Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (the AML/CFT Act), lawyers are required to verify the identity of clients and any persons acting on their behalf. This is achieved through regulated “Customer Due Diligence” (CDD) processes. The intent of the AML/CFT Act is to better protect New Zealand against criminal activity and enhance our international reputation as a safe place to do business. While not all transactions you may undertake will be subject to the AML/CFT Act, "captured activities" that you may instruct us on (such as matters involving property or business sale and purchase, formation of trusts and legal entities, matters involving the transfer of funds or business and trust related matters etc) will require us to first complete CDD before we can start working on your behalf.

What this means to you

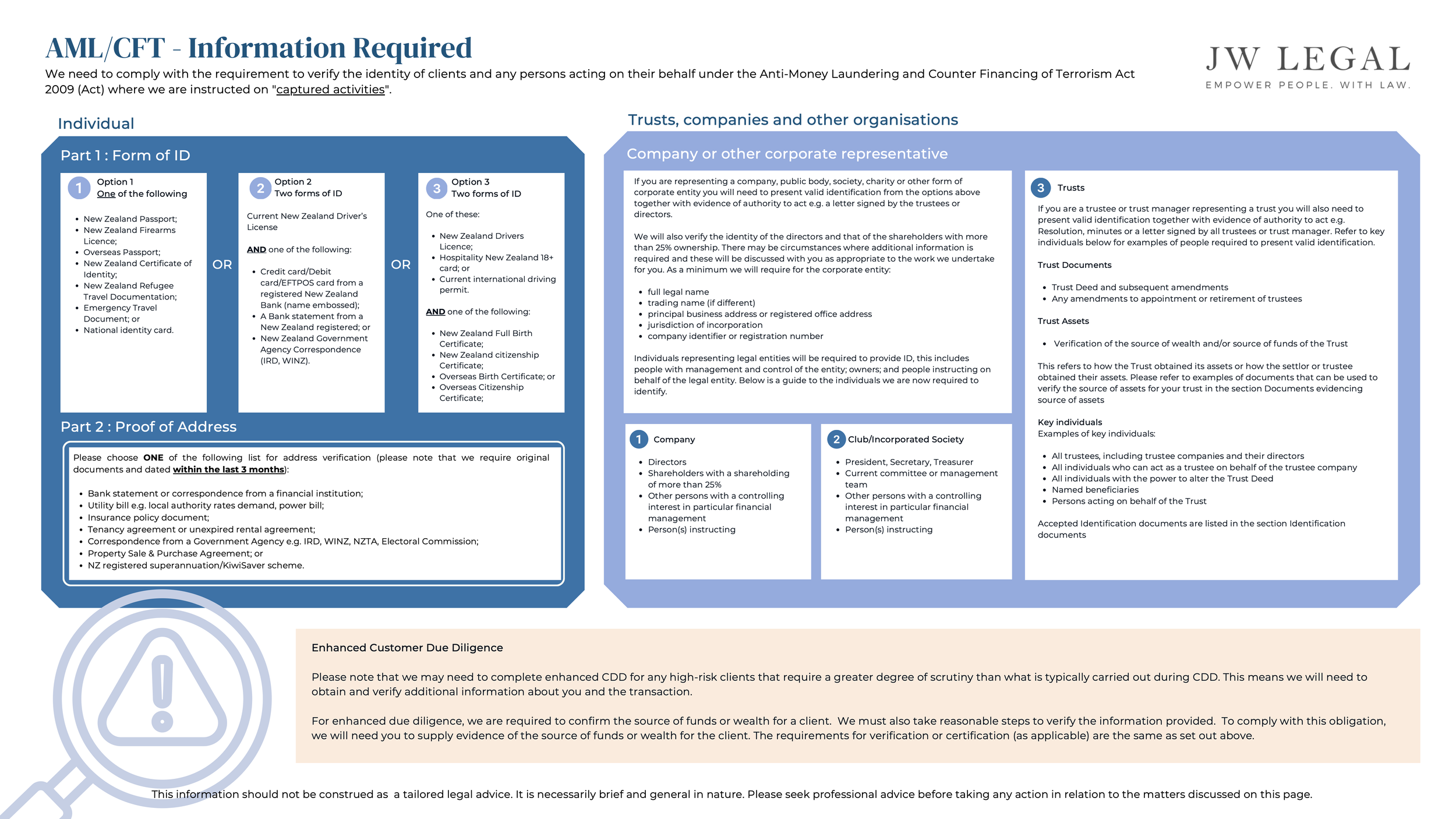

Just like banks, the AML/CFT Act requires us to collect identification information on you and anyone acting on your behalf. The information that we need to obtain and verify to meet these legal requirements includes:

your full name;

your date of birth;

your address;

(and in some situations) source of wealth and/or source of funds.

In situations where our clients are trusts or companies or other similar bodies corporate, the AML/CFT Act will require us to obtain CDD information about the key parties associated with those entities (such as key shareholders, directors, trustees, settlors and certain beneficiaries). You can find more information about individual identification documents and our guidance for trusts/companies/other organisations the chart at the bottom this page.

Please note that we may need to complete enhanced CDD for any high-risk clients that require a greater degree of scrutiny than what is typically carried out during CDD. This means we will need to obtain and verify additional information about you and the transaction (e.g. obtain and verify source of wealth/source of funds). The reasons that we may consider a client high risk are:

you have a trust or another vehicle for holding personal assets;

you are a non-resident client from a country that has insufficient anti-money laundering and countering financing of terrorism systems or measures in place;

you have a company with nominee shareholders or shares in bearer form;

you are a politically exposed person (PEP); or

we consider that the level of risk involved is such that enhanced CDD should apply.

We ask that all our clients complete the CDD process as quickly as possible on request to ensure that we can complete any new work you may need us to perform, otherwise, we may be prohibited from acting for you. To ensure compliance with applicable laws, we may be required to provide information about you, persons acting on your behalf or other relevant persons to third parties (such as government agencies). There may be circumstances where we are not able to tell you or such persons if we do provide information. Please ensure that you and/or any of the persons associated with the instruction are aware of and consent to this. It is important to ensure that all information provided to us is accurate. If the information required is not provided, or considered by us to be potentially inaccurate, misleading, or in contravention of any law, we may terminate or refuse to enter into an engagement.

How to provide this information

You can submit the documents required via this form and you will need to bring the original documents with you when you first meet with us. If you are unable to visit in person we can accept a certified copy of the original document, or may even be able to verify your identity through our online compliance process.

To assist us in being able to act for you in any matter on an urgent basis, please feel free to contact us and provide the information ahead of time, so as to minimise any delays resulting from the obligations imposed on us under this legislation.